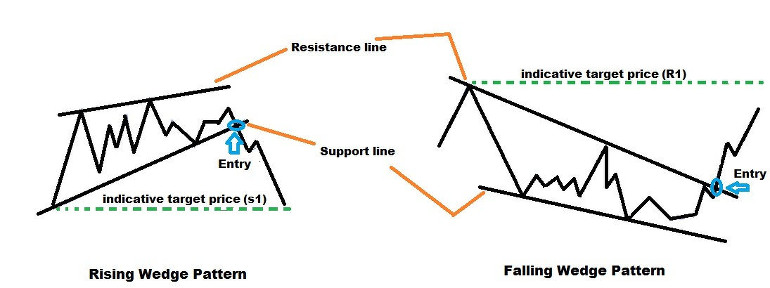

The prior trend before formation of this pattern is an downtrend, and a buy signal is given when the upper resistance is broken towards the end of the pattern. It is usually formed over a period of 3-6 months. The price usually fluctuates between an upper downtrendline and a lower downtrendline, where the upper trendline acts as a resistance and the lower trendline acts as a support. The Falling Wedge is a Bullish Reversal Pattern that starts wide at the top but contracts as the prices move lower.

The final break of support indicates that the forces of supply have finally won out and lower prices are likely.Ī Rising Wedge Pattern is usually a Bearish Reversal Pattern where the prior trend is an uptrend, but in rare cases it can also be a Bearish Continuation Pattern, where the prior trend is a downtrend, and then after consolidating in a rising wedge pattern, the prices can break down below support and continue in a downtrend.

#Rising wedge trading series

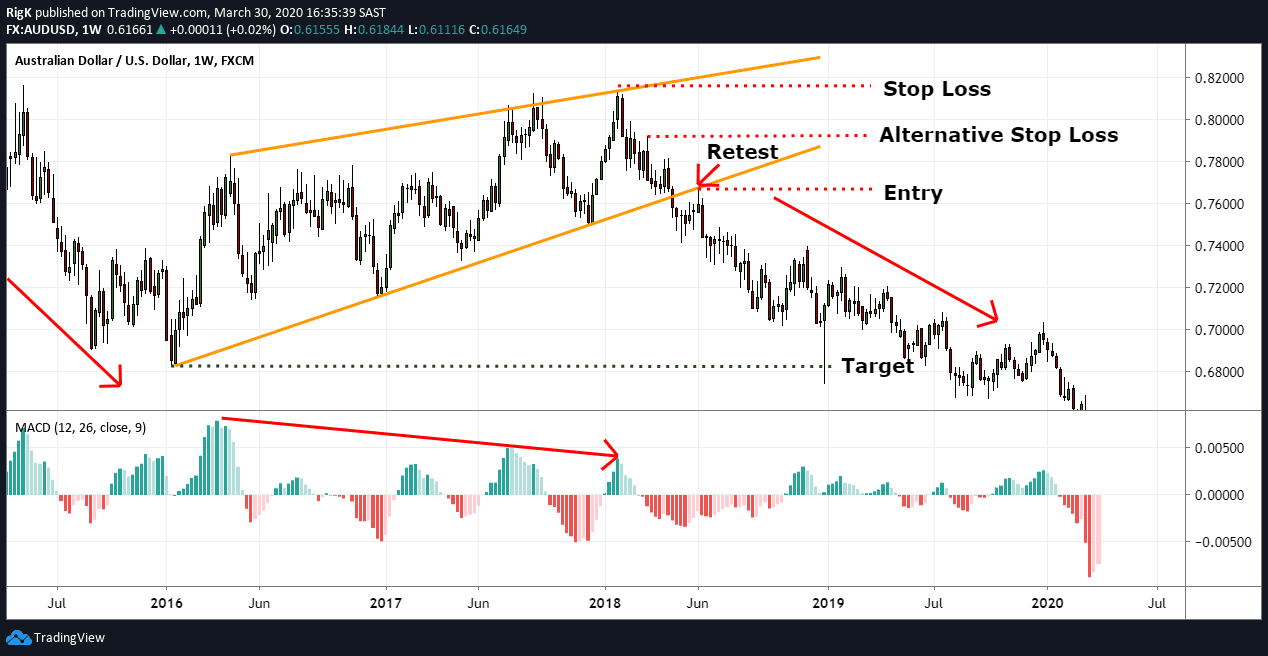

However, the series of higher highs and higher lows keeps the trend inherently bullish. While it is a consolidation formation, the loss of upside momentum on each successive high gives the pattern its bearish bias. An increase in volume on the support break can also give a confirmation about the sell signal.Īn example of a Rising Wedge Pattern is shown in the screenshot below. The prior trend before formation of this pattern is an uptrend, and a sell signal is given when the lower support is broken towards the end of the pattern. The price usually fluctuates between an upper trendline and a lower trendline, where the upper trendline acts as a resistance and the lower trendline acts as a support. The Rising Wedge is a Bearish Reversal Pattern that starts wide at the bottom but contracts as the prices move higher. A common stop level is just outside the wedge on the opposite side of the breakout.In this blog post, we will look at the importance of Rising and Falling Wedge Patterns which are important reversal Classical Patterns. The target can be estimated through the technique of measuring the height of the back of the wedge and extending it in the direction of the breakout. Number 1: Point at which the price finds resistance at the lower part of the wedge. Place a sell order on the retest of the trend line (broken support now becomes resistance). These wedges tend to break upwards.Ĭonservative traders may look for additional confirmation of price continuing in the direction of the breakout. As in the first illustration, wait for the price to trade below the trend line (broken support). In other words: the highs are falling faster than the lows. The second is Falling wedges where price is contained by 2 descending trend lines that converge because the upper trend line is steeper than the lower trend line. In other words: the lows are climbing faster than the highs.

The first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. There are 2 types of wedges indicating price is in consolidation. In such parts, trades appear as converging lines creating the pattern. The trend extremes make up a segment known as the wedge formation. It combines a price range going narrow with a descending (falling wedge) or an ascending (rising wedge) trend. The Wedge pattern can either be a continuation pattern or a reversal pattern, depending on the type of wedge and the preceding trend. A wedge pattern is a specific market trend spotted on the charts graph.

0 kommentar(er)

0 kommentar(er)